When you move into a rental home or apartment, you expect it to be a safe and comfortable place. But accidents and unexpected events can happen—even in the best buildings. That’s where renters insurance becomes important. It acts as a safety net that protects your personal belongings and finances when life takes an unexpected turn.

Whether you're renting for the first time or finally thinking about adding insurance, understanding how renters insurance works can give you peace of mind and financial security.

What Is Renters Insurance?

Renters insurance is a type of insurance policy designed specifically for people who rent a home, apartment, or condo. It protects your personal belongings—not the building structure—from risks like fire, theft, vandalism, and certain types of water damage. It can also cover liability if someone gets injured in your home.

Think of renters insurance as a financial shield that helps you bounce back after an unexpected loss.

What Does Renters Insurance Cover?

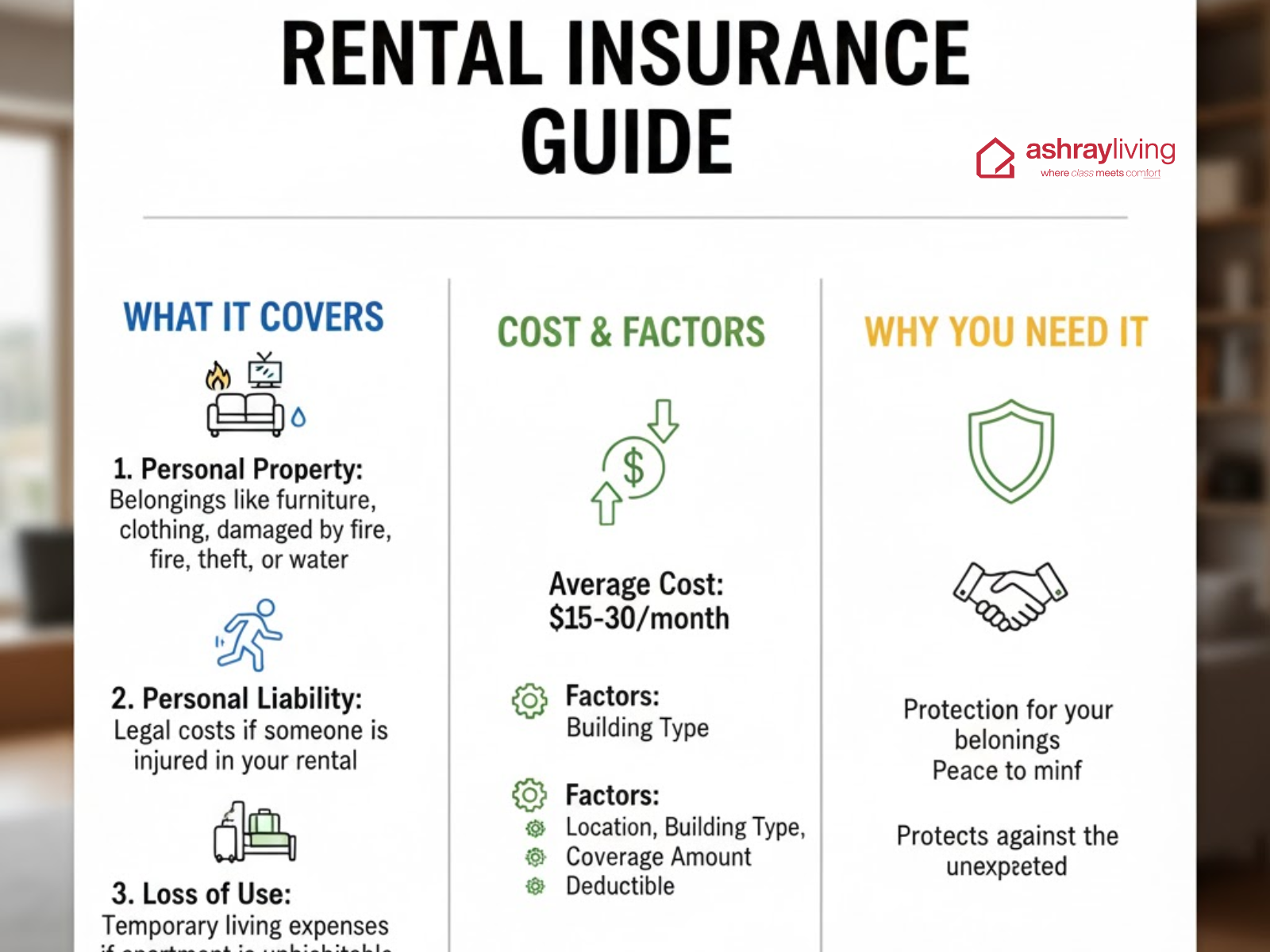

A standard renters insurance policy usually includes three major types of protection:

1. Personal Property Coverage

This covers the cost to repair or replace your belongings if they are damaged, stolen, or destroyed. Covered items may include:

-

Furniture

-

Clothing

-

Electronics

-

Jewelry

-

Kitchen appliances

-

Sports equipment

You can choose between actual cash value, which considers depreciation, or replacement cost coverage, which pays for brand-new items.

2. Liability Coverage

If a guest gets injured in your rental—or if you accidentally damage someone else’s property—liability coverage helps pay medical expenses or legal fees.

3. Additional Living Expenses (Loss of Use)

If a covered event forces you to leave your rental temporarily, renters insurance can help pay for hotel costs, meals, and other living expenses until your home becomes habitable again.

Why Do Renters Need Insurance?

Many renters assume their landlord’s property insurance protects their belongings, but that’s a common misconception. Landlord insurance only covers the building—not your personal property.

Renters insurance protects you from unexpected events, including:

-

Apartment fires

-

Break-ins and theft

-

Burst pipes and water damage

-

Certain natural disasters

-

Accidental injuries inside your rental

Even if you don’t own high-end items, replacing everything you use every day—clothes, electronics, and furniture—can cost thousands of dollars. Renters insurance helps prevent financial hardship during stressful situations.

How Much Does Renters Insurance Cost?

One of the best things about renters insurance is its affordability. On average, policies range from $15 to $30 per month, depending on:

-

Location

-

Coverage amount

-

Deductible

-

Personal risk factors (e.g., previous claims)

For less than the price of a streaming subscription, renters insurance can offer strong financial protection.

What Doesn’t Renters Insurance Cover?

Although renters insurance is comprehensive, it doesn’t cover everything. Common exclusions include:

-

Flood damage from natural disasters

-

Earthquake damage

-

Pest infestations (termites, bed bugs, etc.)

-

Damage from wear and tear

You can purchase additional riders or separate policies for items like high-value jewelry, collectibles, or natural disaster coverage.

Tips for Choosing the Right Renters Insurance Policy

Before buying a policy, keep these tips in mind:

1. Make an Inventory of Your Belongings

Estimate the value of your property so you choose enough coverage.

2. Consider Replacement Cost Coverage

This option ensures you receive the amount needed to replace items—not just their depreciated value.

3. Compare Deductibles

A higher deductible lowers your monthly premium but costs more when you file a claim. Choose a balance that fits your budget.

4. Ask About Discounts

Many insurers offer savings for bundling renters and auto insurance, having security alarms, or living in a gated building.

Is Renters Insurance Required?

Some landlords require renters to carry insurance before signing a lease. Even when it’s optional, it’s strongly recommended. It protects your belongings, finances, and peace of mind—something every renter deserves.

Final Thoughts

Renters insurance may not be the first thing on your moving checklist, but it can be one of the most valuable steps you take. Life is unpredictable, and replacing everything you own after an accident or theft can be overwhelming. With renters insurance, you gain a cushion of financial protection and reassurance that you're not alone when the unexpected happens.

If you’re ready to get covered, start by assessing your belongings, comparing plans, and selecting a policy that fits your needs and lifestyle. A little preparation today can save you from major stress tomorrow.

Related Blogs